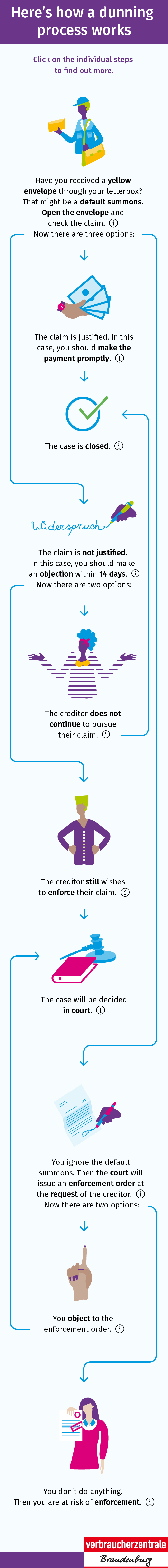

If you receive a court dunning letter in the post, you must take action. With a simple infographic, we explain how a dunning procedure works and what you can do if you receive a dunning letter — from checking whether it is indeed justified and opposition or partial opposition of the claim to payment.

Step-by-step instruction